By: Gerelyn Terzo of Sharemoney

While it’s still early in 2023, several financial trends have already emerged as themes to watch this year. Some of them have spilled over from last year, including high inflation and rising interest rates. However, there are signs that some of the storm clouds are beginning to clear, which bodes well for an otherwise uncertain economy.

After the pandemic, Americans have experienced what the New York Times described as “economic whiplash,” suggesting that the outlook is difficult to predict. Indeed, the economy is in uncharted territory, with economists at odds over whether or not a recession is on the horizon. Despite the uncertainty, consumers can at least be aware of several forces that appear to be defining the financial landscape in 2023.

Table of Contents

1. Easing Inflation

If you’ve been to the grocery store lately, then you’ve seen inflation at work. Prices have gone sky-high, with the price for a carton of cage-free eggs reaching close to $10 in California. Inflation began to rear its head last year and has stuck around for 2023. However, there are early signs that inflation could be abating.

Image by Twitter

In December 2022, the inflation rate as measured by the Consumer Price Index (CPI) eased to 6.5%. This compares to 7.1% in November and a reading of over 9% in June. December’s inflation reading represented the sixth-straight month of easing, a good sign for the current year. Clearly, inflation is trending in the right direction, and consumers should begin to see signs of relief as a result.

However, it’s not going to return to more normal levels overnight. The Federal Reserve has a target inflation rate of 2%, a far cry from current levels. And while there’s no crystal ball, Goldman Sachs’ chief economist, the general expectation is for inflation to stick with this easing trend to potentially reach 3.2% by year-end.

2. Interest Rates & Savings

In January, the Fed tipped its hand to its mood on monetary policy, and it still appears to be quite hawkish. Policymakers continued to raise interest rates in their first meeting of the new year, albeit at a less aggressive rate than much of 2022 — 0.25 percentage points vs. 0.75 percentage points.

However, signs are pointing to more rate hikes to come, the next one of which could be in March when the Fed convenes once again. This could work to consumers’ advantage if you let it.

True enough, as interest rates rise, consumers pay more to service their debt, including credit cards, auto loans, and mortgages. However, a rising rate environment also benefits savers because the savings rate also inches higher (even though not quite as high as on the payment side). If consumers play it right, they can earn more on their money and maintain some purchasing power as inflation falls.

The evidence shows that consumers can earn more from an online savings account vs. a savings account at a brick-and-mortar bank branch. Online savings apps are offering savings rates in the range of 4%-4.5% compared to a national average of 0.33% at financial institutions.

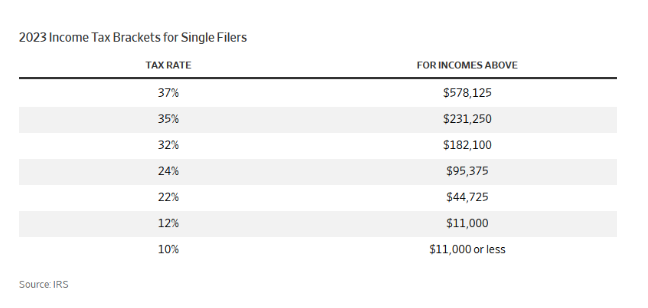

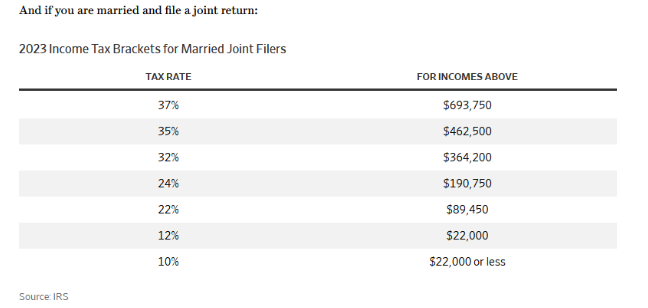

3. Income Tax Bracket Inflation

Another way that inflation has crept in is in tax brackets, where the IRS has made adjustments to reflect the current cost of living. This could wind up being a positive for some taxpayers who will find they owe less at the end of the year than they otherwise would. These changes apply to the current tax year and will be applicable when you file your taxes in 2024.

According to the latest IRS adjustments, tax brackets and the standard deduction have been revised higher. This is to offset the impact of higher inflation. While the IRS makes a habit of adjusting track brackets to reflect nuances in the cost of living, 2023’s changes have been more dramatic than normal.

Meanwhile, the 2023 standard deduction has been increased by 7% vs. 2022, giving filers the opportunity to report lower yearly earnings before determining their obligation. Deduction changes include:

- For singles, it rises to $13,850 vs. $900 last year

- For households, it rises to $20,800 vs. $19,400.

Experts advise taxpayers to “bunch” their deductions instead of itemizing them to take advantage of the changes.

Below is a breakdown of the changes in the tax brackets in 2023 for singles and households:

Image by WSJ

4. Recession

The million-dollar question even among economists remains whether or not there will be a recession in 2023. The jury is still out and the views are mixed. If a recession does emerge, economists tend to expect it will be in the second half of the year.

But even the most dire forecasts have been toned down by leaders in the financial industry. JPMorgan CEO Jamie Dimon previously predicted an economic hurricane was brewing. Now he’s saying the consumer is holding up better than expected and are probably in a better position than they were during the last financial crisis of 2008-2009.

The things that concern him include the ongoing war in Ukraine, the seemingly unending interest rate hikes, and runaway inflation. He’s not just worried about the U.S. economy and says the slowdown will be felt around the world and is already being felt in European countries.

As of October 2022, Dimon predicted that a recession would emerge in the U.S. economy sometime between April and July of this year. As for how long it could last, that’s anyone’s guess. The Fed is aiming for a “soft landing” but the war in Ukraine is a wildcard. Stocks could have another 20% to fall, so investors should brace for this as well.

Conclusion

Now that you’ve got a glimpse into some of the key financial themes of 2023, you should be able to make even more informed decisions about your money. With the threat of a recession still looming, experts advise people to save their money and continue to invest. It’s still early in the year and anything could happen. But chances are these financial themes are likely to be a constant as the seasons change in 2023.